All About Private Schools Debt Collection

Wiki Article

Debt Collection Agency Things To Know Before You Buy

Table of ContentsOur Business Debt Collection DiariesNot known Factual Statements About Dental Debt Collection 5 Easy Facts About Personal Debt Collection DescribedSome Known Incorrect Statements About International Debt Collection

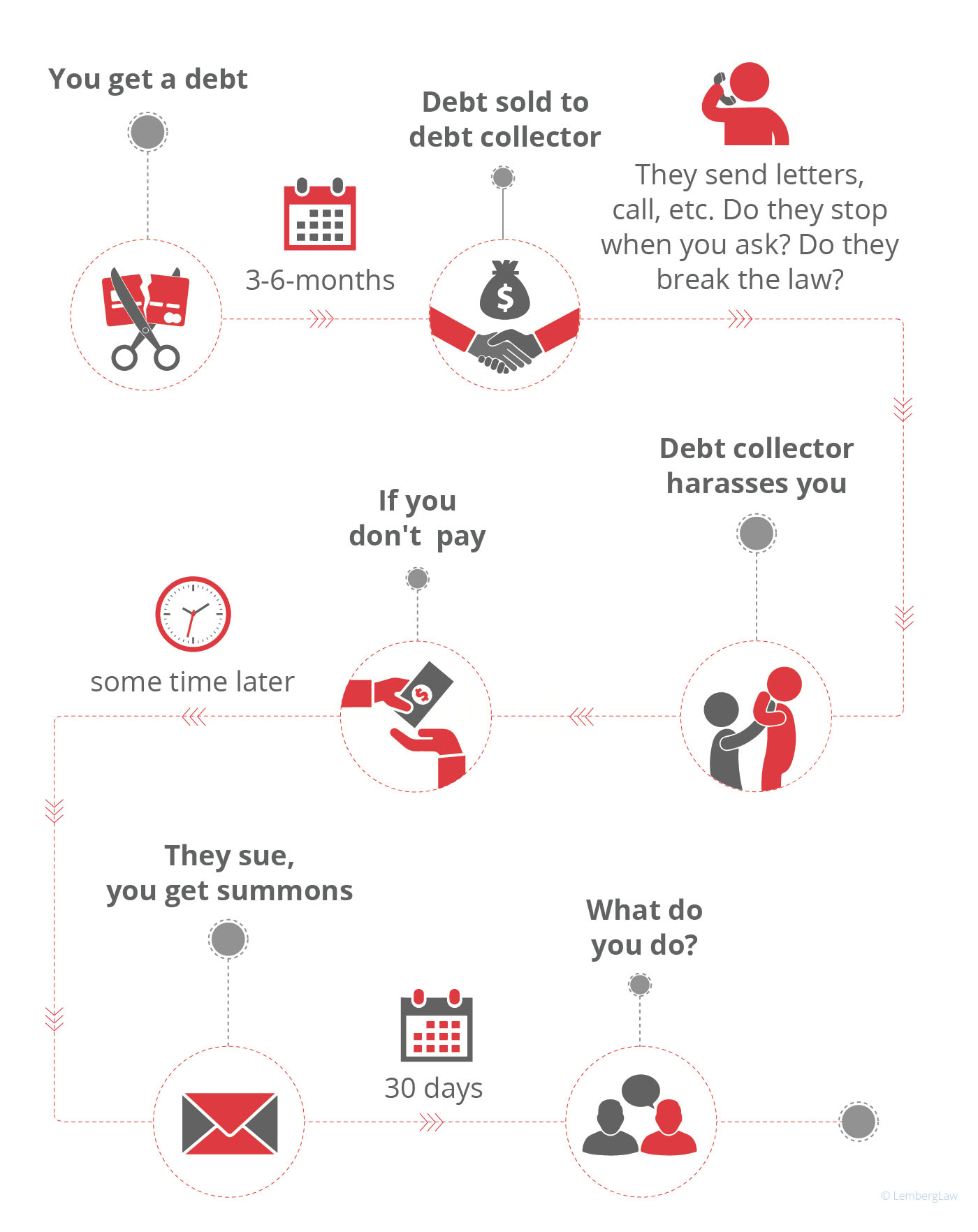

A financial obligation collector is a person or company that remains in business of recovering money owed on delinquent accounts - Dental Debt Collection. Lots of financial obligation collectors are worked with by business to which cash is owed by individuals, running for a level charge or for a percent of the amount they are able to accumulateA financial obligation enthusiast tries to recoup past-due financial debts owed to creditors. Some financial debt collectors purchase delinquent financial obligations from lenders at a price cut and then seek to collect on their own.

Debt collection agencies that breach the policies can be sued. At that factor the financial debt is stated to have gone to collections.

Overdue settlements on credit history card balances, phone costs, car finances, utility costs, as well as back taxes are instances of the delinquent debts that an enthusiast may be tasked with fetching. Some companies have their very own financial obligation collection divisions. The majority of find it easier to work with a financial obligation enthusiast to go after unpaid financial obligations than to chase the customers themselves.

Facts About Personal Debt Collection Uncovered

Financial debt enthusiasts may call the person's personal and work phones, and also also appear on their doorstep. They may also contact their family, friends, as well as neighbors in order to verify the call info that they have on apply for the person. (However, they are not enabled to disclose the factor they are trying to reach them.) On top of that, they may send by mail the borrower late payment notifications.m. or after 9 p. m. Neither can they incorrectly claim that a borrower will be jailed if they fail to pay. In addition, a collector can not literally damage or threaten a debtor and isn't permitted to confiscate possessions without the authorization of a court. The law likewise provides debtors certain rights.

Both can stay on credit rating reports for as much as seven years and have an unfavorable result on the person's credit report, a big part visit here of which is based on their payment history. No, the Fair Financial Debt Collection Practices Act uses just to customer debts, such as home mortgages, debt cards, automobile fundings, student lendings, and medical costs.

Getting The Personal Debt Collection To Work

Because frauds are typical, taxpayers need to be careful of anyone purporting to be working on behalf of the Internal revenue service as well as inspect with the IRS to make certain. Some states have licensing requirements for financial debt collection agencies, while others do not.

A financial debt collection company is a company that acts as middlemen, collecting clients' overdue debtsdebts that are at the very least 60 days previous dueand remitting them to the original financial institution. Learn more concerning exactly how financial debt collection agenies and also debt collection agencies function. Dental Debt Collection.

Financial obligation enthusiasts earn money when they recoup overdue financial debt. Some collection agencies bargain negotiations with customers for less than the amount owed. Website Extra federal, state, and local rules were implemented in 2020 to secure consumers confronted with financial debt problems associated with the pandemic. Financial debt debt collector will certainly pursue any overdue debt, from overdue trainee car loans to unsettled clinical costs.

Some Known Questions About Debt Collection Agency.

As an example, an agency could accumulate just overdue financial debts of at the very least $200 and much less than two years old. A credible agency will certainly also limit its work to accumulating financial obligations within the law of constraints, which varies by state. Being within the law of limitations means that the financial debt is not too old, and the financial institution can still seek it legitimately.A financial debt collection agency has to depend on the borrower to pay as well as can not take a paycheck or reach into a checking account, also if the directing and also account numbers are knownunless a judgment is acquired. This indicates the court orders a debtor to pay off a particular amount to a particular creditor.

Debt collection agencies additionally speak to delinquent consumers that already have judgments against them. Also when a financial institution wins a judgment, it can be challenging to collect the cash.

When the original financial institution click here to read figures out that it is not likely to gather, it will certainly cut its losses by selling that debt to a financial obligation buyer. Creditors package numerous accounts along with similar features and sell them en masse. Debt purchasers can pick from packages that: Are fairly brand-new, without various other third-party collection activity, Older accounts that collection agencies have actually fallen short to gather on, Accounts that drop somewhere in between Financial obligation customers frequently buy these bundles through a bidding procedure, paying on typical 4 cents for every single $1 of debt stated value.

Report this wiki page